In many of my posts on Financial Independence, I have always emphasized that my focus is on independence, not retiring early. Yet, I often get questions about the second part—What will you do after retiring early? Will your standard of living drop even after achieving financial independence?

To answer this, I ran a 3-month experiment—I stopped relying on my monthly income and tried living only on my savings. And what a learning experience it was!

Here’s what I realized very quickly:

- The earlier you reach financial independence, the more pressure you feel to stretch your savings.

- If you’re in your early 40s, you still have many milestones ahead—kids’ education, family expenses, lifestyle needs.

- Without a regular income, I started questioning every expense—even small family purchases. I became so cautious that I almost frustrated my family with my frugality!

That’s when I truly understood the importance of alternate sources of income.

If you plan to take a break after financial independence, make sure you have new income streams in place. I would have felt much more at ease if I had some cash flowing in to mimic my job income.

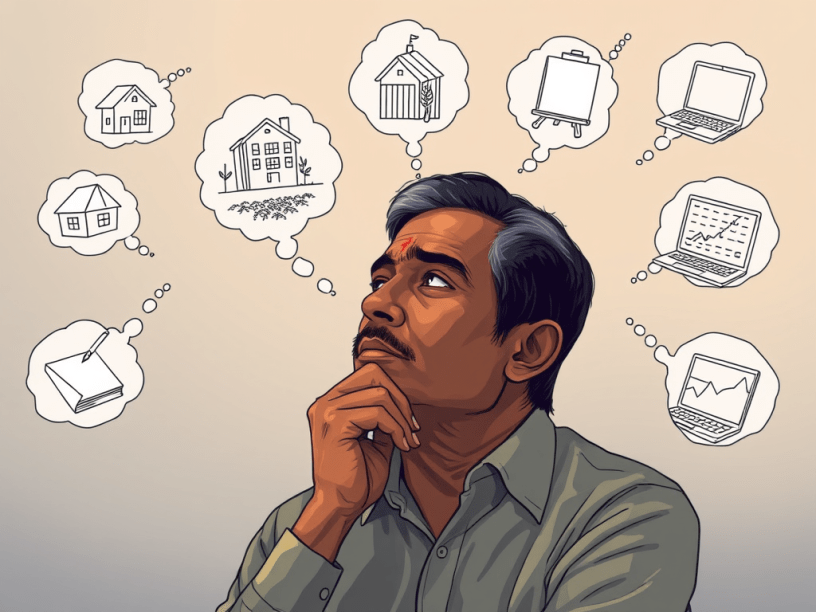

Here’s what you can do:

✔ Rental income – Invest in real estate that generates passive income.

✔ Monetize a hobby – Teach, write, or create something valuable.

✔ Side gigs – Use your skills to freelance or consult.

✔ Farming – Grow high-value crops like avocados, ginger, or pepper that generate seasonal income.

✔ Investing – Generate returns through dividends, bonds, or other passive investments.

✔ Digital products – Create e-books, online courses, or templates that sell passively.

Financial independence is not about leading a slow, retired life. It’s about having the freedom to do what truly matters to you—without constantly worrying about money.

If you are on this journey, I would highly recommend you think about alternate income streams